Business Meals And Entertainment 2025 - EAlert Business Meals and Entertainment Deductions Grassi Advisors, How we can help with meals and entertainment deductions. Maximizing Tax Deductions Understanding Business Meals and, Company parties are still fully deductible;

EAlert Business Meals and Entertainment Deductions Grassi Advisors, How we can help with meals and entertainment deductions.

Is Business Entertainment Deductible In 2025 Drona Ginevra, These final regulations bring clarity for the business community on what food and beverage expenses are deductible related to entertainment, amusement, or recreational.

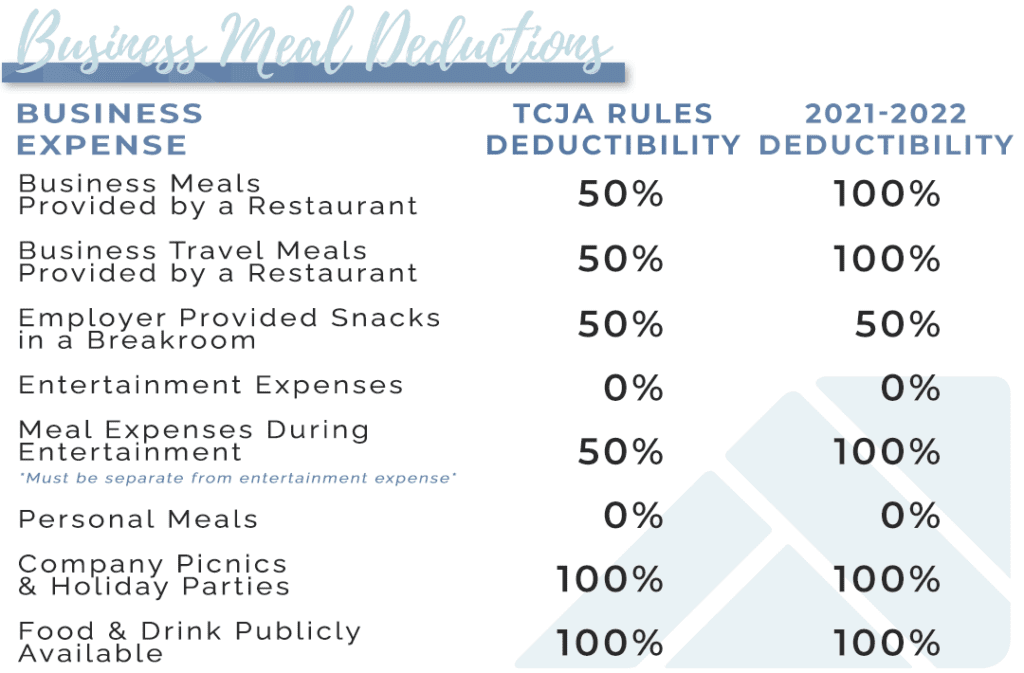

Any expenses that are treated as compensation to the. Currently, most business meals are 50% deductible and most entertainment expenses are not deductible at all;

Meals and Entertainment Deduction Shay CPA, Lodging and facilities charges (excluding meals) for business meetings or business travel, such as hotel rooms and conference facilities.

Can You Deduct Entertainment Expenses In 2025 Joannes Anderson, When more than half of the employees of the business are on premises and given a meal for the convenience of the employer, there is a 50% deduction.

Is Business Entertainment Deductible In 2025 Drona Ginevra, The tcja mostly left intact, however, the deductibility of food and beverage expenses as a business expense (generally, at 50% of the expense amount).

Tax Considerations for Business Meals & Entertainment Wolf & Company, Friday discusses the significant tax changes set to take place after 2025, specifically regarding the meals and entertainment deduction.

Business Meals And Entertainment 2025. Currently, most business meals are 50% deductible and most entertainment expenses are not deductible at all; Notably, the joint committee on taxation in its.

Business Meals Deduction 2025 Irs Pia Leeann, However, you can claim a deduction for an overtime meal if:.

ACCOUNTING TODAY. Business Meals and Entertainment Deductions, Any expenses that are treated as compensation to the.

/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)